glendale az vehicle sales tax

Sales Tax Office in Glendale AZ. Peoria AZ Sales Tax Rate.

Used Certified Loaner Gmc Vehicles For Sale In Peoria Az Liberty Buick

Sales Tax Rate Chart.

. A state use tax or other excise tax rate applicable to vehicle purchases or registrations that is lower than Arizonas 56 percent state transaction privilege tax rate. When the sales tax is greater. 6 rows The Glendale Arizona sales tax is 920 consisting of 560 Arizona state sales tax.

The current total local sales tax rate in Glendale AZ is. The County sales tax rate is. Water Sewer Trash Bill.

Internal Revenue Service - Federal Tax Information. ARIZONA DEPARTMENT OF REVENUE. And tax reciprocity with Arizona meaning that the nonresidents state will provide a credit for the Arizona state TPT amount paid by the nonresident purchaser at the time of the sale.

Name A - Z Sponsored Links. Consignment Service Furniture Stores Used Furniture 3 Website 623 251-5281. For states that have a tax rate that is less than Arizonas 56 tax is collected by the state of Arizona at the time of purchase.

The current total local sales tax rate in Glendale CA is 10250. 17 lower than the maximum sales tax in AZ. For previous rates and fees contact Customer Service at 623 930-3190.

This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Glendale Arizona is. Government Offices Federal Government Tax Return Preparation-Business 800 829-1040.

Taxes reported for the City of Glendale must be on a separate line of the State return with a City Code of GE. Cities and towns share in a portion of the collection total. In addition to taxes car purchases in Arizona may be subject to other fees like registration title and plate fees.

The December 2020 total local sales tax rate was also 10250. Surprise Sales Tax in Glendale AZ. You can find these fees further down.

Lake Havasu City AZ Sales Tax Rate. Glendale AZ Sales Tax Rate. Bail Bonds Bankruptcy Attorneys Car Accident Lawyers Divorce Attorneys Family Law Attorneys Lie Detector Tests Private Investigators Process Servers Stenographers Tax Attorneys.

Link is external Download User Guide. The 92 sales tax rate in Glendale consists. Object Moved This document may be found here.

Register with the State of Arizona. GE stands for City of Glendale. The voter-approved 1 increase passed in 2010 does not translate into additional state-shared revenue and will be repealed at the end of three years.

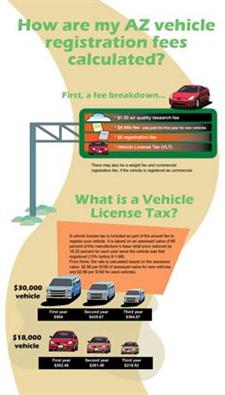

For more information on vehicle use tax andor how to use the calculator click on the links below. The business code for residential rental on the State return is 045. 4 rows Glendale AZ Sales Tax Rate.

Mesa AZ Sales Tax Rate. Sales Taxes Amount Rate Glendale AZ. Gilbert AZ Sales Tax Rate.

Impose a 610 rate effective August 01 2012. 28 rows Impose a 540 rate effective November 01 2007. County tax can be as high as 07 and city tax can be up to 25.

Glendale City Hall 5850 W. Marana AZ Sales Tax Rate. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Glendale AZ.

Arizona collects a 66 state sales tax rate on the purchase of all vehicles. The Arizona sales tax rate is currently. Maricopa AZ Sales Tax Rate.

Glendale in Arizona has a tax rate of 92 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Glendale totaling 36. The rate imposed is equal to the state rate where the car will be registered. However the total tax may be higher depending on the county and city the vehicle is purchased in.

Object moved to here. You can find more tax rates and allowances for Glendale and Arizona in the 2022 Arizona Tax Tables. - Sales Tax includes food and services where applicable - Real tax taxes are based on the local median home price - Car taxes assume a new Honda Accord costing 25000.

The Vehicle Use Tax Calculator developed and implemented by the Arizona Department of Revenue ADOR is a tool that provides that convenience with a one-stop shop experience. See reviews photos directions phone numbers and more for the best Recreational Vehicles Campers in Glendale AZ. Tax On Food.

Residential Rental City Tax Rate effective 1112007 22. Oro Valley AZ Sales Tax Rate. State Transaction Privilege Tax Sales Tax The current rate of the State sales tax is six and six-tenths percent 66.

City Hall Offices are open Monday - Friday from 730 am. Name A - Z Sponsored Links. Goodyear AZ Sales Tax Rate.

The Glendale sales tax rate is.

Sanderson Ford Glendale F 150 Escape Explorer Bronco Sport Or Ranger

Swissbike X50 18 Speed Mountain Bike 20 Gloss Black Swissbike Http Www Amazon Com Dp B003asygya Ref Cm Sw R Pi Dp Fy Folding Bike Bikes For Sale Hybrid Bike

Empi Imp Dune Buggy Buggy Vw Dune Buggy

Apache Junction Njrotc Benefit Vehicle Show Feb 5 The Daily Independent At Yourvalley Net

2021 Arizona Car Sales Tax Calculator Valley Chevy

1989 Used Porsche 911 Carrera 2dr Speedster At Scottsdale Ferrari Serving Phoenix Az Iid 21288939

Used Cars For Sale In Phoenix Serving Glendale Az

New Chevrolet Trailblazer Vehicles For Sale In Peoria Phoenix At Autonation Chevrolet Arrowhead

Historyadventuring On Instagram Don Sanderson Ford In 1955 5630 Nw Grand Avenue Glendale Arizona Car Dealership New Cars Ford

Used Cars For Sale Under 15 000 In Phoenix Az Cars Com

Your Top Vehicle Registration Questions And The Answers Adot

Low Mile 1978 Chevrolet Blazer Trailering Special Chevrolet Chevrolet Blazer Modern Muscle Cars

2022 Used Land Rover Discovery Sport Se R Dynamic 4wd At Scottsdale Ferrari Serving Phoenix Az Iid 21307541

2012 Ford F 550 Tiffany Coach Bus 28 Pax Limousine Party Bus For Sale Party Bus For Sale Party Bus Buses For Sale

Used Certified Loaner Vehicles For Sale In Peoria Az Liberty Buick